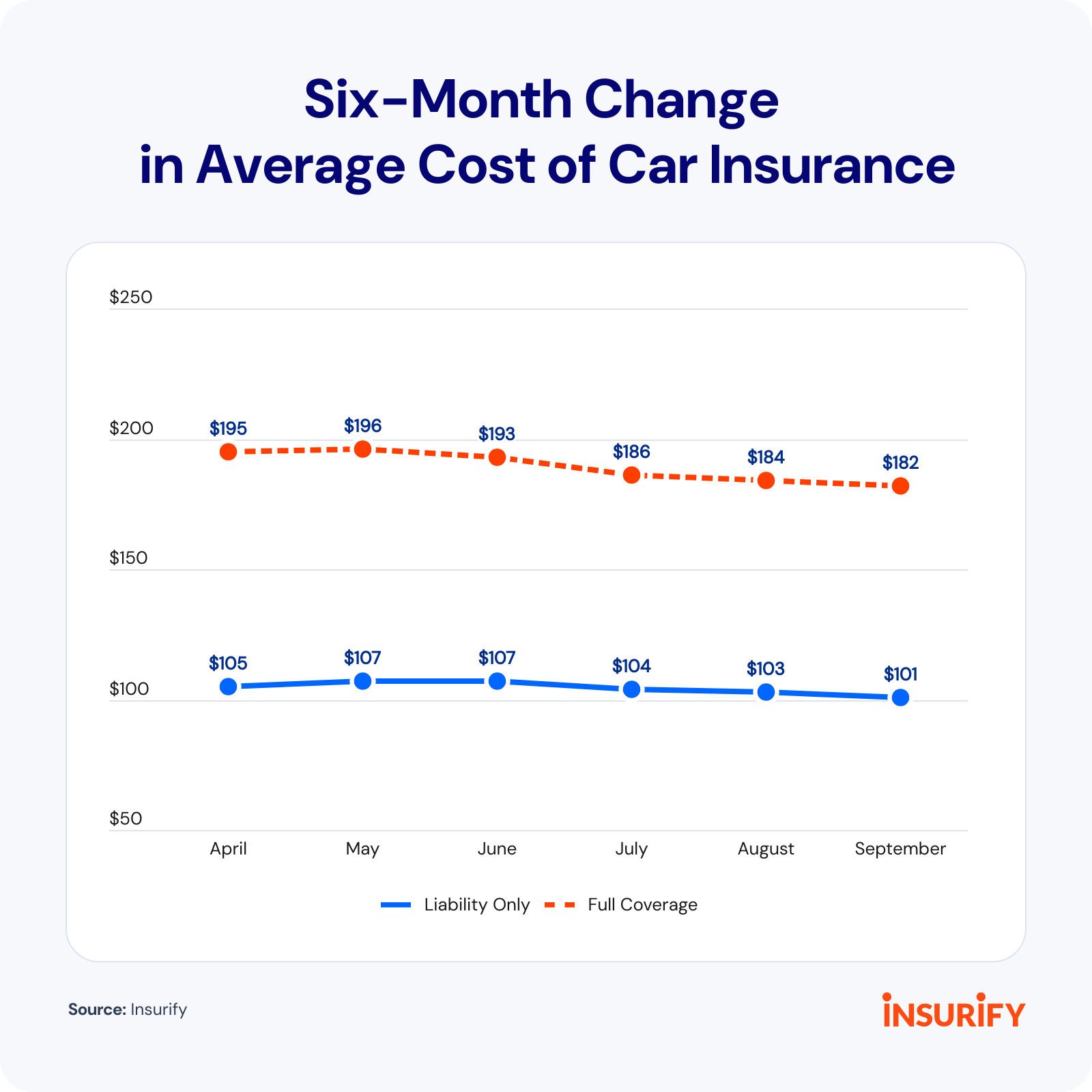

Car insurance rates continued to fall in September. The national average rate for full-coverage car insurance dipped from $184 per month to $182 per month, according to . The national average liability rate decreased as well, down from $103 per month to $101.

Average cost of car insurance by state as of October 2025

Insurance rates can vary greatly based on location, which influences factors like exposure to extreme weather, repair costs, traffic congestion, and vehicle crime rates.

Here are the monthly averages for full and liability coverage across the country.

5 states with the highest car insurance rates as of October 2025

Washington, D.C., remains the most expensive location for car insurance in the nation.

Maryland, Rhode Island, Delaware, and New York continue to rank among the most expensive states, though the overall average rate has dropped by as much as $10 in each state over the last month.

5 states with the lowest car insurance rates as of October 2025

New Hampshire ousts Wyoming to take over the No. 1 spot for most affordable car insurance, with rates well below the national averages of $101 for liability and $182 for full coverage. All five of the cheapest states return from the month before.

Here are the states with the lowest rates as of Oct. 1.

Factors that affect car insurance rates

Car insurance rates can vary significantly among drivers based on many factors that insurers use to estimate risk. Some common rating factors include:

Driving history: Insurers consider whether a driver has a clean record or infractions such as speeding, driving under the influence, or causing an accident.

Age: Driving experience and accident risks closely correlate with age, actuarial data shows.

Gender: Statistically, women are less likely than men to cause accidents and engage in risky behaviors like aggressive driving.

Location: Where a policyholder lives and drives affects their exposure to risk factors such as extreme weather, vehicle crime rates, and accident rates.

Credit history: Data indicates that drivers with better credit are less likely to file car insurance claims than those with poor credit.

Vehicle make and model: Vehicles that are less expensive or have multiple safety features cost less to insure.

Vehicle usage: Driving fewer miles per year reduces a vehicle’s exposure to the day-to-day risks of driving.

Vehicle equipment: Safety features like lane-keeping assist and blind-spot warning can help decrease the risk of accidents.

Coverage type: Generally, liability-only coverage costs less than full-coverage car insurance.

Coverage limits: The amount of coverage you buy affects annual premiums. Minimum coverage is typically the cheapest but doesn’t offer enough financial protection for most drivers.

Deductible: A higher collision and comprehensive coverage deductible (liability coverage has no deductible) reduces rates since the insurer assumes less risk for the cost of repairs.

How to save on car insurance

±õ²Ô²õ³Ü°ù¾±´Ú²â’s projects the average cost of car insurance will rise by 5% this year.

Every state except New Hampshire requires drivers to carry a minimum amount of liability coverage. Insurance professionals recommend buying more coverage for greater financial protection in at-fault accidents. And if a driver leases or finances a vehicle, the leasing company or lender will require them to buy full-coverage car insurance.

Drivers can take steps to reduce the cost of car insurance, including:

Drive safely. Avoid speeding, hard braking, distracted driving, and other risky driving behaviors that could cause a claim.

Look for discounts. Most insurers offer discounts, such as good student or multi-car discounts, that can help reduce premiums.

Increase the deductible. A higher collision and comprehensive deductible typically leads to lower rates.

Adjust coverages. Liability-only coverage is the cheapest insurance available, and minimum coverage is the cheapest liability option. But drivers should be careful and buy enough coverage to adequately protect themselves financially.

Comparison shop. Drivers should compare rates from multiple companies every time their policy comes up for renewal.

Related articles

Methodology

Insurify data scientists analyzed more than 97 million rates from car insurance applications in ±õ²Ô²õ³Ü°ù¾±´Ú²â’s proprietary database to calculate the premium averages displayed on this page. These premiums are real quotes that come directly from ±õ²Ô²õ³Ü°ù¾±´Ú²â’s 50+ partner insurance companies in all 50 states and Washington, D.C. All premium averages reflect the cost of car insurance for drivers between the ages of 20 and 70 with a clean driving record and average or better credit.

For most states, full-coverage premium prices represent two-year rolling medians in order to manage extreme market volatility seen over the past few years as insurance companies have sought substantial rate increase approvals and deprioritized writing new policies in the face of rapidly rising costs.

Liability-only premium prices — as well as full-coverage prices in Maine, Massachusetts, Michigan, Montana, North Dakota, Nebraska, New Hampshire, New Jersey, and Vermont — represent one-year rolling medians.

Liability-only premium averages correspond to policies with the following coverage limits:

Bodily injury limits between state-minimum rates and $50,000 per person, $100,000 per accident

Property damage limits between $10,000 and $50,000

No additional coverage

Full-coverage premium averages correspond to the same bodily injury and property damage limits in addition to:

Comprehensive coverage with a $1,000 deductible

Collision coverage with a $1,000 deductible

For full-coverage historical data, please visit ±õ²Ô²õ³Ü°ù¾±´Ú²â’s Auto Insurance Data Center. Data housed in the Data Center dates back to 2021 and represents the median yearly cost of full coverage for drivers between the ages of 20 and 70 with a clean driving record and average or better credit. Monthly prices are two-year rolling medians in order to manage extreme market volatility seen over the past few years as insurance companies have sought substantial rate increase approvals and deprioritized writing new policies in the face of rapidly rising costs.